Overview

The Graduate Certificate in Corporate & Financial Services Law (GCCFSL) is aimed at graduates with a law degree, particularly in-house legal counsel and lawyers in local or international law firms who are seeking to upgrade their skills and knowledge in corporate law generally, or specifically in relation to the banking and finance sector.

This programme offers a wide selection of regular and intensive courses taught in Singapore by our own faculty members as well as visiting professors, who are top corporate and finance law practitioners and academics from around the world. It is conducted on a part-time basis and legal professionals have the flexibility to read a minimum of one 3-week intensive course or one regular 13-week course at 4, 5 or 8 Units per semester.

Candidates who have not read and passed a general course in Company Law at NUS or its equivalent in a common law jurisdiction are required to read Elements of Company Law (4 Units). Candidates who have read and passed a general course in Company Law at NUS or its equivalent in a common law jurisdiction may apply for exemption.

Admission Requirements

Candidates will be admitted based on the following admission requirements:

- A good Bachelor's or Juris Doctor degree in Law

- Minimum TOEFL iBT 100 / TOEFL paper-based score of 600-603 / IELTS 7.0, if Law degree was not in English.

Graduation Criteria

Candidates must pass all courses and attain a total of 12–15 Units (typically 3 courses) within a maximum candidature period of 36 months in order to be awarded the GCCFSL. In practice, most candidates complete the programme within 24 months or less.

Course Durations

Classes are typically held in-person at the NUS Bukit Timah Campus or NUS Kent Ridge Campus (from January 2026).

The class size for each course is typically limited to 50 students and the class will comprise LLB, JD, LLM, Exchange and other graduate students.

A semester-long course is a 36-hour course taught once a week over the course of 13 weeks from August to November (Semester One) and from January to April (Semester Two).

An intensive course is a 27-hour course taught intensively over 3 weeks and scheduled as follows:

| Time | |

| Monday | 6:30pm - 9:30pm |

| Wednesday | 6:30pm - 9:30pm |

| Friday | 2:30pm - 5:30pm |

The following are the periods when intensive courses are conducted in the Faculty:

| Semester | Weeks (Phase One) | Weeks (Phase Two) |

| Semester One | Week 1 to 3 (August) | Week 4 to 6 (September) |

| Semester Two | Week 1 to 3 (January) | Week 4 to 6 (February) |

Asessments

The examination and assessment of student performances in the programme will be conducted through various assessment modes such as class participation, assignments, research papers, take-home examinations and final examinations as stated in each course description. Some courses may have an examination some time after the 13th week. The time and date of the exam will be made known at the time of course selection. Students are encouraged to review the examination and assessment details for each course before opting for it.

SILE-CPD Points

Participants who wish to obtain CPD Points are reminded that they must comply strictly with the Attendance Policy set out in the CPD Guidelines. For participants attending the face-to-face activity, this includes signing in on arrival and signing out at the conclusion of the activity in the manner required by the organiser, and not being absent from the each day of a course for more than 15 minutes. For those participating via the webinar, this includes logging in at the start of the webinar and logging out at the conclusion of the webinar in the manner required by the organiser, and not being away from each day of a course for more than 15 minutes. Participants who do not comply with the Attendance Policy will not be able to obtain CPD Points for that day of the course.

Please refer to http://www.sileCPDcentre.sg for more information.

Public CPD Points :

Practice Area Code :

Training Level :

Up to 72 points for 8-Unit Semester Course

Up to 36 points for 5-Unit Semester Course

Up to 27 points for 4-Unit Intensive Course

Banking and Finance

Intermediate

List of Courses

Click HERE for the list of courses offered in AY2025-26, Semester One.

(Please note that course information, including class schedule and examinations, may be subjected to changes.)

Course Fees

Course Fees

| Categories | Fee Per Course (4-5 Units) |

| Full Fee for Non-citizen | SGD 5,886.00 |

|

Singapore Citizens & Permanent Residents |

SGD 3,996.00 |

The total programme fee for 3 courses (assuming student passes all 3 courses and obtains the required Units for graduation) is between SGD17,658.00 to SGD11,988.00 (inclusive of 9% GST), depending on the nationality of applicant.

A Student Services Fee is also applicable each semester.

Once enrolled in the programme, students will be billed for the course(s) and the student services fees. Payment is due before the start of each Semester.

SkillsFuture Credit

Most of the listed courses are eligible for SkillsFuture Credit (SFC) claim. All Singaporeans aged 25 and above can use their SkillsFuture Credit from the government to offset part of the course fee. Applicants who wish to use the SkillsFuture Credit may refer to https://www.skillsfuture.gov.sg/credit for more details or login to the SkillsFuture Portal to check their SFC balance.

The programme is also eligible for SkillsFuture Credit (Mid-Career).

Apply Now

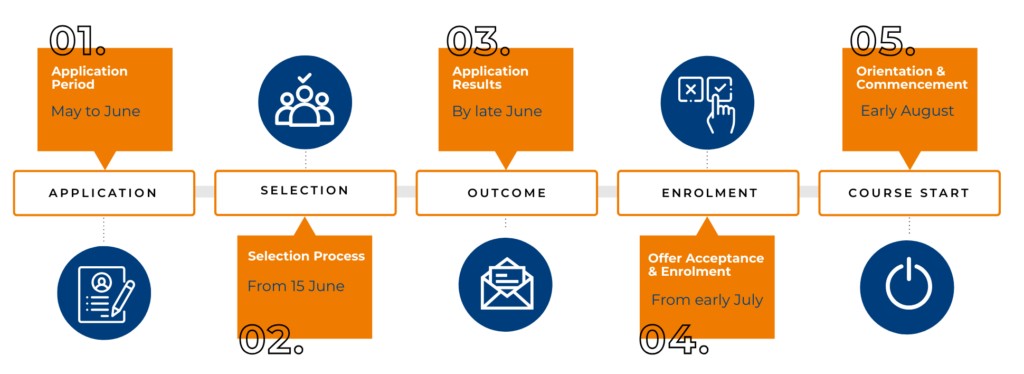

Application Timeline

There is only 1 intake per academic year. The following is the application period:

| Intake Period | Application Period |

| AY2025/26 Semester One (commencing Aug) | 6 May to 6 June 2025 |

The following is the admission process and timeline:

Supporting Documents

Before you start, you should have details of your academic qualifications, employment and the PDF version of the following required documents at hand:

- A personal statement on why you wish to enroll in this programme, the nature of your work and such other information that you would like us to consider (not more than 1 page)

- Curriculum Vitae

- Scanned copy of NRIC/FIN/Passport(foreigner)

- Scanned copy of your LLB/ JD Degree Certificate (with a certified English translation if the original is not in English)

- Scanned copies of your LLB/ JD Transcripts (with a certified English translation if the original is not in English)

- Any other supporting documents (e.g. TOEFL/IELTS results), if applicable

Any omission of supporting documents or information required in the Online Application Portal will render the application void. All supporting documents, if not in English, must be accompanied by copies of the English translated version.

Application Procedures

The application form will take about 15 minutes to complete.

Follow the steps below to apply:

| 1 |

Go to the NUS Online Application Portal |

| 2 | Identify yourself as “Member of the Public” |

| 3 | Select “Specialist/ Graduate Cert” and “Click Here to Apply or Check Status” |

| 4 | If you are first-time user, please click on "Register New User Account". Otherwise, please log in to your existing account. |

| 5 | Click on “Submit New Application” |

| 6 | Select "2025/2026 Semester 1" for Academic Year & Semester |

| 7 | Select "GD Cert (Corp & Fin Svcs Law)" for Programme/Student Category. |

| 8 | Select "GD Cert-Corp & Fin Svcs Law" for Specialisation/Level of Study and click "Apply Now" |

| 9 | Click on "Add/Select New Course" |

| 10 | Select "Faculty of Law" and click "Search" |

| 11 | Select and rank your courses and complete your application. |

Click HERE to apply.

Frequently Asked Questions

Click HERE to view the FAQs relating to our Graduate Certificate programmes.

Contact

Please contact NUS Law Academy at email: nuslawacademy@nus.edu.sg.